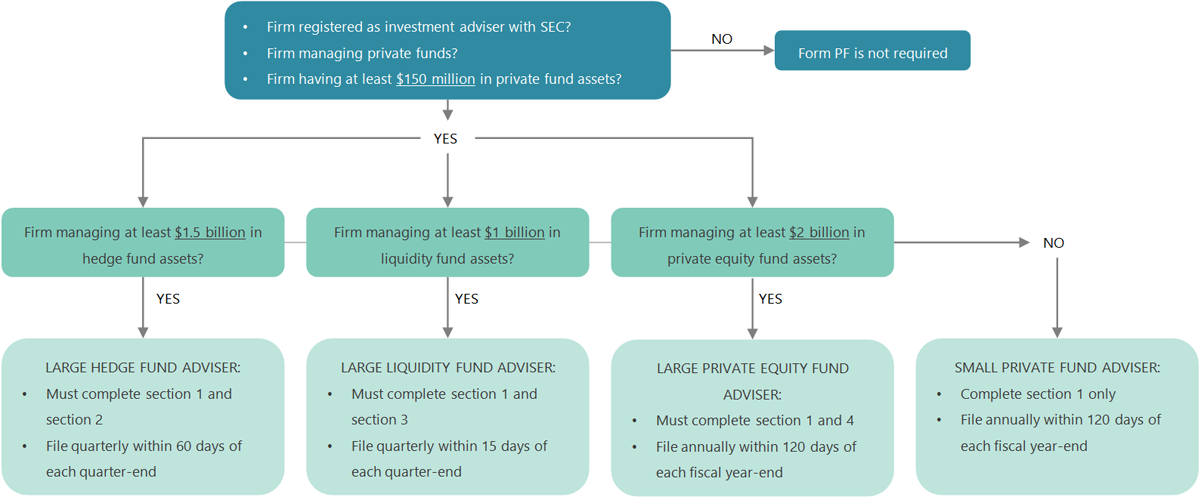

FORM PF, FORM ADV

01

DATA INTEGRATION AND DATA QUALITY CHECKS

- Import data from administrators and third-party data sources if needed, data aggregation

- Perform and support all the reporting calculations needed: asset classification, risk exposure, scenarios, VaR

- Perform data quality checks and XML validation tests in accordance to SEC standard schema and additional business rules to ensure successful reporting upload

02

REPORT GENERATION

- Support Form PF reporting in different formats (excel, pdf, xml) aligned with SEC template.